As Mark McKinnon rightly quoted - Technology and social media have brought power back to the people. We are already in technology and transformation era. When we think of early 80s or 90s the techno change was around 7-10 years. But we are now advancing era in which we have technocrats all around and change is as speedy as 3-5 years.

Continuum, the top mobile development company in Toronto believes - We are transforming from digitization to digitalization.

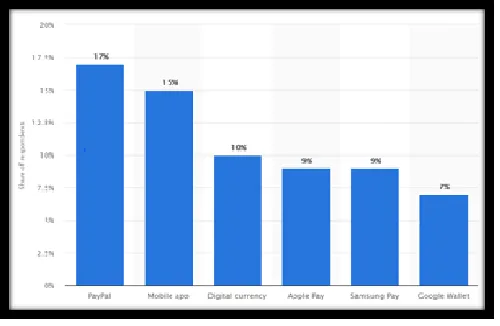

With various payment mode becoming simplified with online transactions, cashless cards and eventually Canadians are using mobile phone for making countless payment with #paymentapps- A secure gateway. Let us study some interesting findings to see how the present & future of #paymentapp looks like:

Source: Satistica

Let us understand more about top four payment apps.

#1. Apple pay:

Apple pay’s Canda launch was in the year 2015, Apple pay supports most major credit or debit card schemes, including American Express, Visa, Mastercard and UnionPay. Participating banks may vary by region. Knowing apple as a highly recognized and trusted for data security product, apple users jump to use apple pay being the most authenticated medium. It works amazingly and replicates like the payment done with any other credit cards.

Payment process is simple:

- Customer shares electronic details to retailers

- Relevant bank authorization happens

- The transactions displayed as completed within seconds

- Finally, it’s a happy retailer and customer both ?!

#2. Google pay:

Google pay is having comparatively shorter span but it has taken a great pick with its greater number of users and it has merged services of Google wallet and Android Pay. There is a reward system offered in each service to ensure customers makes purchases through their mobile device.

- The immediate question follows mind is, how can one accept Google Pay?

- Business owners need to check their availability on accepting payment terminals through Tap or Contactless methods

Business owners usually would have technology which is well equipped to operate this payment mode, if not you can contact continuum to get a detailed idea on how to work this out.

To know more about Google pay do checkout Google Pay website, and Google’s blog!

#3. Samsung Pay:

Samsung is featuring it as an additional technology smart art for Canadians. With the popular demand of Apple pay and Google pay Samsung have given enough confidence to its trusted customers of being available at 90% places. The key feature that it brings is Field Communication (NFC) and Magnetic Secure Transmission (MST) technology to enable more secure contactless payments. Whether you need to tap or swipe a card, Samsung Pay makes payment possible at almost any POS terminal in Canada. Samsung Pay have partnered with large Chinese financial services solution UnionPay in 2016. It will be worth knowing how Samsung pay can cater and penetrate Canadian market.

#4. The Starbucks App:

It is an interesting concept for shakes and coffee lovers. Trust us it is a hit in million minds with Canadians. It also has an added advantage of its universal acceptance on Android and Apple app platform. App allows customer to pay via secure code that appear in the smart phone linked with the respective payment card. The key highlight of this feature is, on each order there will be reward points which customer can avail in future. Additionally, customer can place an order and can pick up the order to the nearest linked store. As per #moneris 30 percent of the order strike on Starbucks app. Which means good revolution with more space to do more.

Being able to connect on these app becomes convenient and inevitable both. To know how these app works for business owners in background reach us, we will attempt to showcase a demo of how exactly it works for you.